Offshore Trustee Services: Your Entrance to Global Financial Security

Using the International Advantage: Leveraging Offshore Count On Providers for Optimal Property Growth and Diversification

Are you seeking to make the most of the development of your assets while diversifying your profile? Look no more than overseas count on services. By taking advantage of the international benefit, you can utilize these solutions to accomplish ideal asset growth and diversification. In this short article, we will certainly check out the advantages of offshore counts on, vital considerations for establishing them, and methods for taking full advantage of possession development and diversification. Get ready to navigate worldwide laws and conformity while unlocking the full capacity of offshore trust services.

Recognizing Offshore Counts On and Their Advantages

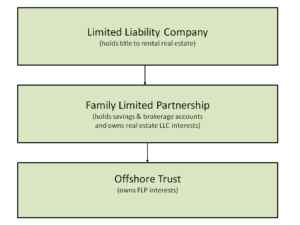

Comprehending overseas counts on and their advantages can supply you with possibilities for ideal property development and diversity. Offshore trust funds are lawful arrangements that permit you to protect and handle your assets in a territory outside your home nation. By using overseas depends on, you can make the most of different benefits such as tax obligation optimization, asset protection, and privacy.

One of the key advantages of offshore trust funds is tax obligation optimization. Several offshore jurisdictions supply beneficial tax programs, permitting you to reduce your tax obligation responsibilities and maximize your wide range. By structuring your properties via an offshore trust fund, you can legally decrease your tax obligation concern and keep more of your profits for financial investment and development.

Personal privacy is additionally a considerable benefit of overseas counts on. Unlike several onshore territories, offshore territories frequently have stringent privacy legislations that safeguard your individual and financial information. This privacy can be important for individuals who value their personal privacy and want to maintain their monetary events private.

Overall, understanding overseas depends on and their benefits can open up substantial possibilities for you to enhance your property development and expand your holdings. By taking advantage of beneficial tax obligation regimens, possession protection, and privacy, you can protect and grow your wide range in a efficient and safe and secure manner.

Key Factors To Consider for Developing an Offshore Trust Fund

An additional essential consideration is the trustee you pick for your overseas trust fund. This private or organization will be in charge of managing the depend on and making decisions in your place. It's vital to choose a trustee that is experienced, credible, and knowledgeable concerning the regulations and requirements of the picked territory.

Furthermore, it's necessary to carefully intend and structure your overseas depend guarantee it satisfies your details purposes. This might involve figuring out the purpose of the trust fund, specifying the recipients, and setting out the terms under which the count on properties will certainly be distributed.

Finally, you ought to also consider the tax obligation ramifications of establishing an offshore count on. While these trust funds can offer substantial tax obligation benefits, it's crucial to speak with a tax obligation expert to guarantee compliance with all relevant tax obligation legislations and reporting demands.

Optimizing Property Growth Through Offshore Count On Structures

To take advantage of your overseas count on structure, you'll go to my blog want to meticulously consider techniques that can help you take full advantage of the growth of your assets. One essential strategy is diversity. By spreading your properties across various countries and industries, you can reduce the danger of being heavily based on a single market or field. offshore trustee. This can assist safeguard your wealth from variations in any one economic situation and potentially enhance your returns.

Additionally, it is essential to consistently assess and change your financial investment portfolio within the count on (offshore trustee). Markets and financial problems transform in time, so it's crucial to remain informed and make modifications as necessary. This might entail rebalancing your portfolio, including or getting rid of specific investments, or discovering new possibilities

Finally, dealing with experienced professionals that specialize in offshore trust structures can give important advice and support. They can aid you navigate the complicated lawful and regulatory landscape, guarantee your trust is compliant, and aid you identify and carry out one of the most reliable development techniques for your details goals and situations.

Expanding Your Profile With Offshore Counts On

Take into consideration spreading your investments across various nations and industries within your offshore depend more minimize dangers and possibly increase returns. Diversifying your portfolio is a basic strategy that can assist shield your investments from the volatility of any type of solitary market or industry. By spending in numerous nations, you spread your risk and minimize the impact of any type of one nation's financial or political events on your overall profile.

Purchasing various markets is just as essential. Industries can act in different ways depending on various elements such as market cycles, governing adjustments, and technological improvements. By expanding across markets, you can alleviate the threat of being greatly revealed to a solitary sector that may experience recessions.

When choosing nations and sectors for your overseas depend on, take into consideration factors such as political stability, economic development prospects, and regulative environment. Study and evaluation are crucial to determining countries and markets with strong potential for development.

In addition, by investing in a worldwide diversified profile, you can benefit from opportunities that may not be readily available in your house country. Some nations might have emerging markets or sectors that use higher growth possibility or special investment opportunities.

Navigating International Rules and Compliance for Offshore Trust Providers

Comprehending global regulations and compliance is crucial for managing your overseas trust efficiently and making certain that you meet all legal needs. When it comes to overseas count on services, there are numerous regulations in place that you need to browse.

One key element of worldwide laws is tax compliance. Various territories have various tax legislations, and it is important to follow them to prevent any type of tax obligation evasion claims. Additionally, there are policies relating to coverage and disclosure needs. Many countries have executed measures to fight cash laundering and terrorist financing, which suggests that offshore depends on might need to reveal particular information to the authorities.

Furthermore, it is vital to be conscious of any changes or updates in global laws. The regulative landscape is continuously developing, and staying educated can assist you adapt your overseas trust fund method appropriately. Engaging with a specialist advisor who concentrates on offshore trust solutions can be helpful in navigating these regulations and making certain that you stay compliant.

Final Thought

In final thought, overseas depend on solutions provide people the opportunity to harness a worldwide advantage for ideal property development and diversification. By understanding the benefits of offshore counts on and meticulously considering essential aspects, you can optimize your property growth through effective trust structures.

In this article, we will check out the benefits of overseas depends on, key factors to consider for developing them, and strategies for making best use of property development and diversity.Comprehending offshore visit their website trusts and their advantages can give you with possibilities for ideal asset growth and diversity. By structuring your possessions with an offshore trust fund, you can lawfully decrease your tax worry and maintain more of your earnings for investment and development.

In final thought, offshore trust fund solutions provide individuals the possibility to harness an international benefit for optimal asset growth and diversity (offshore trustee). By recognizing the benefits of offshore trust funds and very carefully considering vital variables, you can maximize your property growth through effective trust structures